Discounted Payback Period Formula

In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return. In addition the companys COGS is anticipated to grow 10 year-over-year YoY through the entire projection period.

Payback Period Formula And Calculator

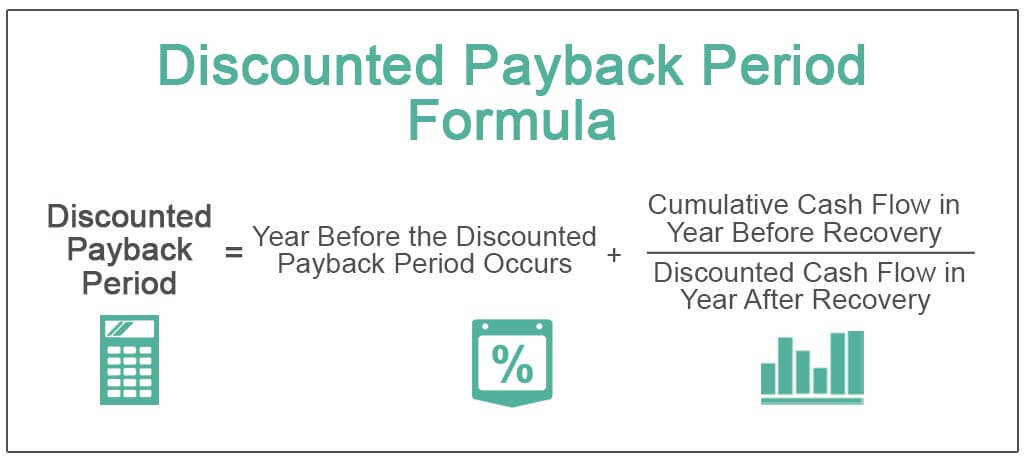

A variation on the payback period formula known as the discounted payback formula eliminates this concern by incorporating the time value of money into the calculation.

. Option 2 which has the highest sum of non-discounted cash flows does in fact not even yield the required return rate of 12. Payback Period Example Calculation. Features of the Payback Period Formula.

This has been a guide to Payback Period Advantages and Disadvantages. COGS Growth Rate 10 YoY. Other capital budgeting analysis methods that include the time value of money are the net present value method and the internal rate of return.

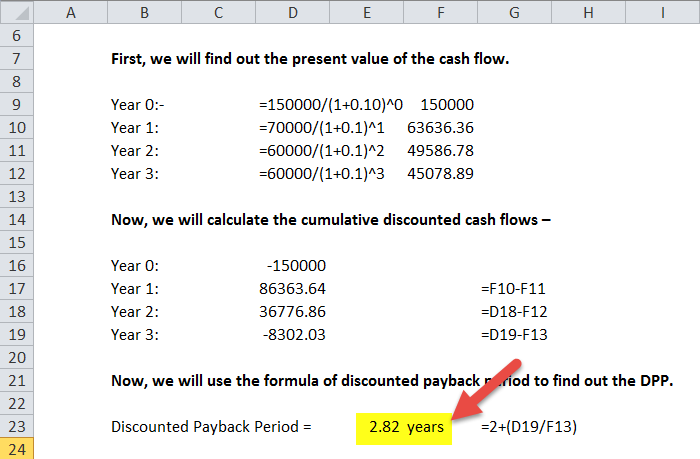

In Excel create a cell for the discounted rate and columns for the. A project costs 2Mn and yields a profit of 30000 after depreciation of 10 straight line but before tax of 30. Lets us calculate the payback period.

For the above example assume the cash flows are discounted at a rate of 12. The payback period formula has some unique features which make. Accounts Payable 30 million.

Let us see an example of how to calculate the payback period when cash flows are uniform over using the full life of the asset. Payback Period 3 1119 3 058 36 years. The longer the payback period of a project the higher the risk.

10mm Cash Flows Per Year. The formula for discounted payback period is. As this rate has been used as a discount rate both the BCR and.

Formula of Discounted Payback Period. Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you. You can learn more about financial analysis from the following articles Dollar-Cost Averaging.

If a 100 investment has an annual payback of 20 and the discount rate is. The discounted payback period is the number of years it takes to pay back the initial investment after discounting cash flows. The last metric to calculate for a capital investment is the payback period which is the total time it takes for a business to recoup its investment.

COGS 100 million. Payback period Formula Total initial capital investment Expected annual after-tax cash inflow. The payback period is the length of time required to recover the cost of an investment.

4mm Our table lists each of the years in the rows and then has three columns. Cash flow per year ln1 discount rate The following is an example of determining discounted payback period using the same example as used for determining payback period. Discounted payback period can be calculated using the below formula.

With a payback period of 471 this option achieves a full amortization in less than 5 years which can be a reasonable time horizon for many organizations. Discounted Payback Period Discounted payback period is the time taken to recover the initial cost of investment but it is calculated by discounting all the future cash flows. Between mutually exclusive projects having similar return the decision should be to invest in the project having the shortest payback period.

Suppose a company has an accounts payable balance of 30mm in 2020 and COGS of 100mm in the same period. Here we discuss the top advantages disadvantages of the payback period along with examples and explanations. First well calculate the metric under the non-discounted approach using the two assumptions below.

Discounted Payback Period - ln1 - investment amount discount rate. This method of calculation does take the time value of money into the account. The payback period is similar to a breakeven analysis but instead of the number of units to cover fixed costs it looks at the amount of time required to return the investment.

The payback period of a given investment or project is an important determinant of whether. In the formula the -C 0 is the initial investment which is a negative cash flow showing that money is going out as opposed to coming in. The discounted payback period will be Discounted Payback Period 4 165m567m 3029 329 years.

When deciding whether to invest in a project or when comparing projects having different. Considering that the money going out is subtracted from the discounted sum of cash flows coming in the net present value would need to be positive in order to be considered a valuable investment. 5 Payback Period.

Discounted Payback Period Actual Cash Flow 1i n i discount rate n number of years.

Discounted Payback Period Formula And Calculator

Payback Period Formula And Calculator

Discounted Payback Period Meaning Formula How To Calculate

Discounted Payback Period Meaning Formula How To Calculate

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Discounted Payback Period Formula With Calculator

0 Response to "Discounted Payback Period Formula"

Post a Comment